A CES without flying taxis would be like one without rampant COVID-19 infections: just not the same. Fortunately, this year's show delivered on that first front (hopefully not the second, however) and it proved some big names are still involved in making that crazy idea a reality someday.

Welcome back to Critical Materials, our morning roundup of the most important industry news in the automotive tech space. We hope you've enjoyed our CES coverage so far; more to come this week and next, including interviews with executives and more previews of the software-driven future from Mercedes-Benz and more.

Until then, today's roundup also covers the latest tactical switch at Fisker, and why Google's Waymo is "the tortoise beating Tesla's hare." Let's dive in.

30%: Flying Car FOMO, Or A Viable Bet On The Future?

Sometimes, I wonder how many big tech investments are driven by pure FOMO. In the car world, it applies to a great many things: new battery technologies, autonomous cars, even novel ways to deliver content from the Spider-man franchise into your vehicle. It's the idea that "If this becomes a thing and we're not on it, we're screwed." It makes sense when almost every car company wants to pivot to becoming a "mobility solutions provider," and nobody can really define what that means.

There are few better examples of this than the flying car. One of my former colleagues at Gizmodo used to say that aerial taxis were "just two years away," because they were always just two years away throughout most of the 2010s. But that trend hasn't gone anywhere, and CES 2024 proved that we've moved beyond the crackpot startup stage to seeing real investments from serious players.

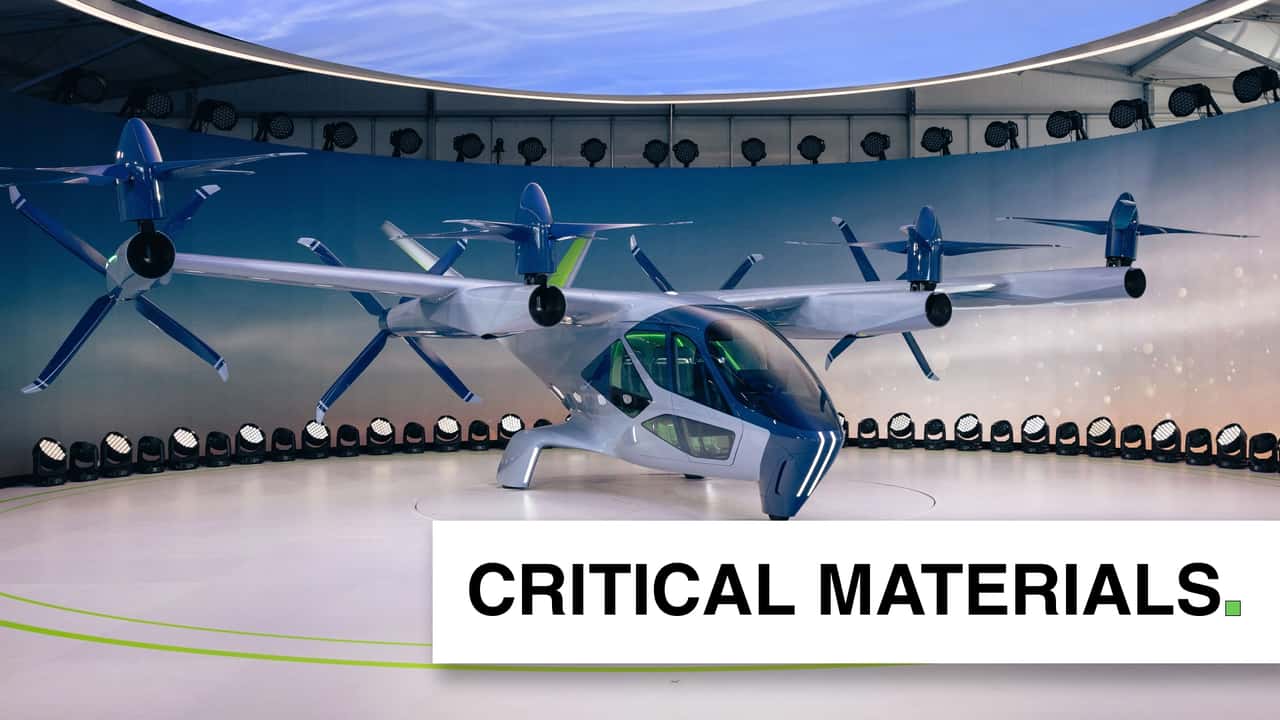

Case in point: Hyundai's CES debut from its air mobility subsidiary, Supernal. The two companies unveiled an electric vertical take-off and landing (VTOL) aircraft at CES this week, and on many levels, this effort is playing the long game. Here's Automotive News to explain:

While the SA-2 often draws comparisons to aircraft as traditional as helicopters and as fanciful as flying cars, this is something that's decidedly different.

The SA-2 is built for one human pilot and four passengers. It relies on eight tilt-rotors to achieve flight — the front four tilt vertically for takeoff and all are horizontally aligned during cruise flight.

They're designed in a way that ensure noise is kept to a minimum. On takeoff, they produce about 65 decibels of sound, said Supernal chief technology officer Ben Diachun. That's as loud as a modern dishwasher, he said.

The SA-2 can travel at speeds of up to 120 miles per hour. Initial trips are expected in the 25-to-40-mile range.

Yes, battery power and not hydrogen—which Hyundai is also heavily investing in. And its service is actually expected to begin in 2028. So not two years away, but four. What's especially interesting is that Hyundai's not alone here. At least two other flush-with-cash automakers who don't want to lose out on "the future" are making similarly large investments:

Hyundai is not the only automaker eying this possibility. Joby Aviation runs a pilot production manufacturing line at its Marina, Calif., headquarters that harnesses the expertise of Toyota Motor Corp., its largest investor. Joby intends to open an assembly facility in Dayton, Ohio, starting in 2025.

Archer Aviation, another eVTOL frontrunner, inked a strategic manufacturing partnership with Stellantis. Construction is underway on a high-volume factory in Covington, Ga. Their initial manufacturing plans call for production of 650 aircraft per year with room to eventually expand to as many as 2,300 per year.

This, even as regulations remain extremely unclear around these vehicles; "like playing football while writing the rules at the same time," one executive said.

Basically, if flying taxis take off—figuratively and also literally—and become A Thing someday, these companies want to plant their flags now so they don't miss out later. Will these dreams become a reality? I guess we'll find out in two years. Or four.

60%: Fisker, Struggling With Delivery Issues, Pivots To Dealers

We've been a bit late on this news thanks to the fog of war that is CES, but there's a lot going on at Fisker these days.

The nascent electric car startup just wrapped a big year with the debut of the Ocean crossover, which is meant to really establish the brand as a contender in an increasingly crowded space, plus even more planned debuts that look quite exciting. But 2023 was also marked with a lot of the usual startup woes: software issues, getting cars actually delivered and keeping cash in the bank, among other things.

Deliveries were a particular problem for Fisker. I think it's fair to say the company lacked the early all-hands-on-deck hype that got cars delivered to customers, including with the help of volunteers.

Now, Fisker is pivoting to the dealership model. And it aims to sign on more than 50 dealers, CEO Henrik Fisker told Automotive News at CES:

The plan to sell through dealers is a complete reversal of the Fisker's original direct sales strategy. The company has struggled to deliver vehicles ever since sales started last year.

"I discovered that in this current situation, with high interest rates, [expensive] real estate, and getting people trained is much more difficult. I think we just went that route because everyone does when you are a startup," Fisker said. "I went to my accounting department and asked what is the cost of selling a car? We decided we would rather give that money to a dealer so that we could expand faster."

Fisker said the decision to offer dealers franchises is based in part on how fast the company can expand with dealers or without, and where the customer base is for EV adopters and Fisker's current customers.

"We are looking for multibrand dealer groups that are owned by someone who can make quick decisions," Fisker said, describing the type of dealers he is looking for.

The dealers don't get a lot of love in the EV world, and that rep is often deserved, but this model does bring its advantages for an early company—not just with sales but service, too. Will this help put Fisker on more stable ground? We'll see how many sign on.

90%: Waymo, The 'Grandma' Of Robotaxis, Is Holding It Down

Google's Waymo may be the ultimate proof that you don't always have to move fast and break things in the tech world. As Bloomberg's Jessica Karl writes today, it could be the next verb in your life—like how you'd "take an Uber" or "Google something." Food for thought:

As it stands, Waymo operates in only two cities — Phoenix and San Francisco. But it’s expanding into Los Angeles and Austin very soon. In a few years, who knows what other cities will allow Waymo to compete with the likes of Uber and Lyft. Will people prefer the comfortable silence of a driverless car over the awkward chitchat you endure with other rideshare businesses? Maybe our jargon will be the first sign of change.

[...] Cruise — the autonomous-driving arm of General Motors — was actually the first to roll out self-driving cars without a safety driver. In 2020, its cars hit the streets of San Francisco. But three years later, the company’s testing permit was revoked after authorities determined it withheld footage of an accident that left a woman critically injured. Dave says “the newly uncovered video showed the Cruise car dragged the woman 20 feet at 7 miles an hour before coming to a stop — on top of her.” In contrast, Waymo’s robocars have traveled 7.1 million miles and have caused less than a handful of minor injuries.

It sounds like the company’s careful approach is paying off. If we want to go driverless, Waymoing with grandma is the only way forward.

It also lumps Waymo in with Tesla in the self-driving race. I tend to draw a line between the consumer car companies and the robotaxi tech companies, but Tesla's bet the farm on full self-driving to the point where CEO Elon Musk didn't want to put out an entry-level car if it had a steering wheel and pedals. So maybe Google's onto something here.

My take is that Waymo is in a good position to wait this out and play its own long game, but the lack of competition in this space and the potential for one company to own it all may not be a good thing for consumers.

100%: What's Your Read On Flying Cars?

That's a wide-ranging term, after all. Are these the future, or destined to always be a few years away?